The Big Mortgage CRM Interview

Retail mortgage CRM solutions often fall short of meeting the unique needs of loan officers. In this interview, discover actionable strategies and learn how a retail mortgage-specific CRM, when properly set up and used according to a few key principles, can transform the way any loan officer works, regardless of their experience level. Learn more about mortgage CRMs from Eric Gemme, BNTouch Mortgage CRM and Greg Uttal, Cyberlink Software Solutions. We will discuss strategies that work with integrations to your favorite LOS: Encompass, MeridianLink Mortgage, Byte, Arive, LendingPad and many more !

Lending Leaders Podcast – The Tech That Matters Most

Had a great time talking with Jim Paolino at LodeStar about our family mortgage business, mortgage automation and my love of change. Even when the change is 30 years in the making.

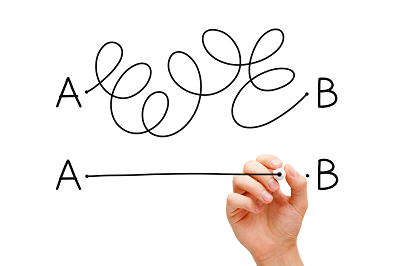

There was so much to unpack in this one-minute question and answer. The conversation left me wanting to dig deeper into the topic. It was a good reminder of the importance of committing to change.

Change isn’t just a decision; it’s a cascade of consequences and opportunities. Like the ripples from a stone tossed into a pond, the effects of our choices to change (or delay it) spread out, not just influencing the way we operate today but the broader ecosystem we’re a part of.

And speaking of opening discussions, hats off to Jim Paolino. He has this unique ability to not just open doors but to make you want to walk through them and stay engaged in the conversation.

Let’s keep the conversation going. Join us on LinkedIn to share your thoughts on making a commitment to change and understanding its far-reaching impacts? Check out Jim’s podcast:

Cyberlink Software Solution’s New Years Holiday Hours

In observance of the New Year’s holiday, Cyberlink will be closed on Monday, Jan. 1, 2024.

We will resume regular business hours on Tuesday, Jan. 2, 2024.

We wish you a happy and successful 2024!

Cyberlink Software Solutions, Inc.

Revolutionizing the Mortgage Industry: The Synergy of AI and Robotic Process Automation

The mortgage industry is no stranger to paperwork, repetitive tasks, and time-consuming processes. However, with the advent of Artificial Intelligence (AI) and Robotic Process Automation (RPA), a transformative wave is sweeping through the mortgage sector, promising efficiency, accuracy, and enhanced customer experiences. This article explores the intersection of AI and RPA in the mortgage industry, highlighting how this powerful combination is reshaping the way mortgage processes are executed.

One of the key challenges in the mortgage industry lies in handling vast amounts of data. AI, particularly in the form of machine learning algorithms, can be employed to automatically extract and process relevant information from documents such as bank statements, pay stubs, and tax returns. RPA complements this by automating the repetitive tasks associated with data entry, reducing the likelihood of errors, and significantly speeding up the loan origination process.

AI-powered chatbots and virtual assistants are changing the landscape of customer service in the mortgage industry. These intelligent systems can answer customer queries, provide real-time updates on the loan application status, and even assist in the application process by collecting customer documentation. Chatbots put your customer service upfront interacting with customers 24/7 from websites, emails, and portals answering questions drawing from information in the lender’s LOS and other data resources. RPA can streamline the back-end processes, ensuring that the information provided by these AI assistants is accurate and up to date.

The mortgage industry is highly regulated, with strict compliance requirements. AI can help ensure that all processes adhere to regulatory standards by continuously monitoring changes in regulations and updating procedures accordingly. RPA takes care of the routine and rule-based compliance tasks, reducing the risk of human error and ensuring that the mortgage processes align with the latest regulatory frameworks.

Verifying the authenticity of documents is a critical aspect of the mortgage approval process. Mortgage Automation’s AI-based Computer Vision can accurately extract information from documents, while RPA cross-verifies the information across multiple systems for accuracy. This not only accelerates the verification process but also minimizes the chances of fraudulent activities.

Once a mortgage is approved, AI and RPA can continue to play a vital role in post-closing and management. Automation can handle routine tasks like printing and sending by snail mail Goodbye Letters, uploading loan document packages and downloading and reconciling purchase agreements from investor’s websites. Extracted information from documents can be inserted into multiple systems like the LOS, accounting, CRM, just to name a few.

The marriage of AI and RPA in the mortgage industry is ushering in a new era of efficiency, accuracy, and improved customer experiences. By automating repetitive tasks, enhancing data processing capabilities, and ensuring compliance with regulations, this dynamic duo is revolutionizing how mortgages are originated, processed, and managed. As the mortgage industry continues to embrace these technologies, we can expect faster turnaround times, reduced operational costs, and a more streamlined and customer-centric mortgage experience.

Cyberlink Software Solutions represents Mortgage Automation, Inc.’s Robotic Process Automation platform. For more information about how AI powers RPA contact Greg Uttal 818 917-2265 guttal@oncyberlink.com.

Was MERS good for the mortgage industry?

In the world of real estate and mortgage lending, the Mortgage Electronic Registration System (MERS) has become an integral part of the industry. Established in 1995, MERS revolutionized the way mortgages are tracked, assigned, and transferred. Shortly after MERS began, in 2003 the first complete MERS transaction management system, eRAMP, was introduced to MERS members. This blog post aims to delve deeper into the workings of MERS, shedding light on its functions, benefits, and connecting eRAMP into the electronic process of mortgage loan transaction management.

What is MERS?

MERS is an electronic registry system that tracks and facilitates the transfer of mortgage ownership interests in the United States. It was created to streamline the mortgage process by digitally recording and tracking mortgage assignments, eliminating the need for physical paperwork. MERS acts as a centralized database, making it easier for lenders, servicers, and investors to manage mortgage loans.

What is eRAMP?

eRAMP (Electronic Registration and Management Program) is a software solution developed by Cyberlink Software Solutions, Inc. It is a transaction management solution designed to work with your LOS to streamline the submission of loan data to register and transfer mortgage loans registered on the MERS system.

How does MERS work?

When a mortgage loan is closed by a lender, it is registered on the MERS system. MERS acts as the nominee for the lender and subsequent loan holders, enabling them to track changes in ownership or servicing rights. As the mortgage is sold or assigned, MERS electronically updates the ownership information, creating a chain of title within the system. This avoids the need for physically transferring and recording documents each time a mortgage changes hands.

How does eRAMP work?

eRAMP allows lenders to manage the processing of loan acquisition and assignment requests by providing a centralized platform for communication between the lender using their LOS and MERs to facilitate the loan registration and transfer process. It automates and standardizes the process, reducing paperwork, increasing efficiency, lowering costs, and minimizing errors. eRAMP submits the information from your LOS required by MERS to register, transfer, and update loan records with MERS.

Benefits of MERS:

1. Efficiency: MERS significantly expedites the mortgage process by facilitating the transfer of ownership electronically. This saves time and costs associated with paper-based record-keeping and physical document transfers.

2. Accuracy: MERS ensures that the chain of title is accurate and complete, as each transfer is recorded within the system. This minimizes the risk of lost, misplaced, or forged mortgage documents.

3. Cost savings: By eliminating the need for physical document transfers, MERS reduces administrative costs, storage expenses, and potential errors related to traditional paper-based mortgage processes.

4. Transparency: The MERS system enables authorized users, such as mortgage lenders and servicers, to access real-time information about the current mortgage holder and status, providing transparency throughout the loan lifecycle.

Benefits of eRAMP:

1. Efficiency: Saves time by eliminating the repetitive steps submitting one loan at a time from your LOS or manually entering loan data on MERS website. In five minutes submit five loans or five hundred loans or more.

2. Accuracy: All loan data submitted to MERS originates from the lender’s LOS system. This minimizes the risk of introducing typographic errors or submitting incorrect loan records. The same data used to create closing documents is used to submit to MERS.

3. Error prevention: eRAMP has business rules to make sure complete data is submitted to MERS and the data is submitted based on MERS requirements. An error warning system alerts users to issues before loans are submitted thereby improving MERS audits and reducing costly mistakes.

4. Transparency: eRAMP syncs with MERS to audit completed and rejected transactions so loan records are not lost in the process. The historical transaction history includes every transaction submitted to MERS assembled in one system in an easy-to-read format.

Conclusion:

The Mortgage Electronic Registration System plays a crucial role in the mortgage industry, offering efficiency, accuracy, and cost savings to lenders, servicers, and investors. By digitizing the mortgage process and maintaining an electronic chain of title, MERS has simplified mortgage assignments and transfers. MERS continues to be a widely used and accepted system in the mortgage industry, providing significant benefits to all stakeholders involved. MERS was indeed a great solution for the mortgage industry.

Working with all LOS systems, eRAMP significantly improves the way lenders submit loan data and transact with MERS. By simplifying all 14 different MERS transactions into one easy to use and controllable program lenders save time, reduce costs, and improve the quality of loan data submitted to MERS. Complicated processes, unnecessary follow-up and disparate systems that complicate working with MERS are eliminated. eRAMP gives lenders the lift they need to maximize many of the advantages of working with MERS.

For more information about working with MERS and the benefits of using eRAMP please visit Cyberlink’s website at www.OnCyberlink.com.

eRAMP Updated for MERS Release 23.1

The MERS system recently released an update (version 23.1) on July 9, 2023. This update allows non-MOM loans to be submitted through the MERS Online Registration channel for immediate registration, making the process easier and quicker. The eRAMP batch processing system has also been updated to take advantage of the non-MOM change, effective starting July 18, 2023. This update enables one to thousands of MOM and non-MOM loans to be submitted in batches to MERS through their Online Registration channel.

Prior to release 23.1 seasoned loans over 270 days were required to be registered using the MERS SFTP batch overnight process. eRAMP continues to manage loan registration submissions following MERS data requirements including the 270 day rule. Any loans exceeding this threshold will be automatically set up to submit to the SFTP batch process.

eRAMP has been the leading batch transaction management system for MERS Registration, Transfer of Rights and over a dozen different transaction types with MERS since 2003. It works with all LOS systems and features an intelligent rules engine to ensure smooth operations.

If you want more information about eRAMP’s support for the latest changes in MERS release 23.1 or would like a demo of our eRAMP MERS transaction management system, visit our website at www.OnCyberlink.com.