In the world of real estate and mortgage lending, the Mortgage Electronic Registration System (MERS) has become an integral part of the industry. Established in 1995, MERS revolutionized the way mortgages are tracked, assigned, and transferred. Shortly after MERS began, in 2003 the first complete MERS transaction management system, eRAMP, was introduced to MERS members. This blog post aims to delve deeper into the workings of MERS, shedding light on its functions, benefits, and connecting eRAMP into the electronic process of mortgage loan transaction management.

What is MERS?

MERS is an electronic registry system that tracks and facilitates the transfer of mortgage ownership interests in the United States. It was created to streamline the mortgage process by digitally recording and tracking mortgage assignments, eliminating the need for physical paperwork. MERS acts as a centralized database, making it easier for lenders, servicers, and investors to manage mortgage loans.

What is eRAMP?

eRAMP (Electronic Registration and Management Program) is a software solution developed by Cyberlink Software Solutions, Inc. It is a transaction management solution designed to work with your LOS to streamline the submission of loan data to register and transfer mortgage loans registered on the MERS system.

How does MERS work?

When a mortgage loan is closed by a lender, it is registered on the MERS system. MERS acts as the nominee for the lender and subsequent loan holders, enabling them to track changes in ownership or servicing rights. As the mortgage is sold or assigned, MERS electronically updates the ownership information, creating a chain of title within the system. This avoids the need for physically transferring and recording documents each time a mortgage changes hands.

How does eRAMP work?

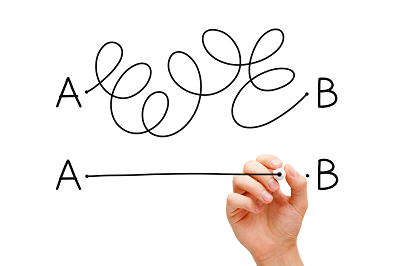

eRAMP allows lenders to manage the processing of loan acquisition and assignment requests by providing a centralized platform for communication between the lender using their LOS and MERs to facilitate the loan registration and transfer process. It automates and standardizes the process, reducing paperwork, increasing efficiency, lowering costs, and minimizing errors. eRAMP submits the information from your LOS required by MERS to register, transfer, and update loan records with MERS.

Benefits of MERS:

1. Efficiency: MERS significantly expedites the mortgage process by facilitating the transfer of ownership electronically. This saves time and costs associated with paper-based record-keeping and physical document transfers.

2. Accuracy: MERS ensures that the chain of title is accurate and complete, as each transfer is recorded within the system. This minimizes the risk of lost, misplaced, or forged mortgage documents.

3. Cost savings: By eliminating the need for physical document transfers, MERS reduces administrative costs, storage expenses, and potential errors related to traditional paper-based mortgage processes.

4. Transparency: The MERS system enables authorized users, such as mortgage lenders and servicers, to access real-time information about the current mortgage holder and status, providing transparency throughout the loan lifecycle.

Benefits of eRAMP:

1. Efficiency: Saves time by eliminating the repetitive steps submitting one loan at a time from your LOS or manually entering loan data on MERS website. In five minutes submit five loans or five hundred loans or more.

2. Accuracy: All loan data submitted to MERS originates from the lender’s LOS system. This minimizes the risk of introducing typographic errors or submitting incorrect loan records. The same data used to create closing documents is used to submit to MERS.

3. Error prevention: eRAMP has business rules to make sure complete data is submitted to MERS and the data is submitted based on MERS requirements. An error warning system alerts users to issues before loans are submitted thereby improving MERS audits and reducing costly mistakes.

4. Transparency: eRAMP syncs with MERS to audit completed and rejected transactions so loan records are not lost in the process. The historical transaction history includes every transaction submitted to MERS assembled in one system in an easy-to-read format.

Conclusion:

The Mortgage Electronic Registration System plays a crucial role in the mortgage industry, offering efficiency, accuracy, and cost savings to lenders, servicers, and investors. By digitizing the mortgage process and maintaining an electronic chain of title, MERS has simplified mortgage assignments and transfers. MERS continues to be a widely used and accepted system in the mortgage industry, providing significant benefits to all stakeholders involved. MERS was indeed a great solution for the mortgage industry.

Working with all LOS systems, eRAMP significantly improves the way lenders submit loan data and transact with MERS. By simplifying all 14 different MERS transactions into one easy to use and controllable program lenders save time, reduce costs, and improve the quality of loan data submitted to MERS. Complicated processes, unnecessary follow-up and disparate systems that complicate working with MERS are eliminated. eRAMP gives lenders the lift they need to maximize many of the advantages of working with MERS.

For more information about working with MERS and the benefits of using eRAMP please visit Cyberlink’s website at www.OnCyberlink.com.