Mortgage Lenders Win Big with No Gamble RPA Program

In the fast-paced and ever-changing mortgage industry, lenders need to adapt quickly to challenges. It is clear that mortgage lending with Robotic Process Automation (RPA) is becoming a trusted tool to help mortgage lenders.

Three interesting facts to think about:

- A mortgage loan process can take over 45 days to complete.

- Employees spend up to 25% of their time on repetitive tasks.

- 80% of finance leaders have either implemented or are planning to implement Robotic Process Automation.

You might be asking yourself, “What is Robotic Process Automation?”

Robotic Process Automation is a software technology that utilizes robots to emulate human actions. RPA helps streamline workflows by automating workflow-driven repetitive tasks. By utilizing robots, tasks are automated to run 24 hours a day, 7 days a week and 365 days a year.

By implementing RPA into your organization, you will find:

- Over 85% of the process of ordering services (e.g. ordering appraisals, credit, flood, work number, etc.) can be automated with RPA.

- RPA solutions can pull data from multiple sources and post the information into your LOS.

- RPA solutions lower the average time needed to process a loan by up to 30%.

- RPA implementation leads to higher data accuracy by reducing human error.

- RPA solutions allow employees to devote their time on value generation and customer satisfaction.

- You won’t need to upgrade or replace any existing applications or software to use RPA solutions.

With a 20% adoption rate in 2021, more and more mortgage lenders are seeing the benefits of RPA. Thus, mortgage lending with RPA is here to stay. Are you ready to take advantage of RPA to help your company increase efficiency, accuracy and improve your bottom line?

Automate Everything

By now you probably have heard about how RPA is transforming the mortgage industry. But have you taken the time to see how using RPA (Robotic Process Automation or bots) could transform your mortgage operations?

If you are like a majority of the people I talk to about bots, you may have outdated information or misconceptions about bots that have stopped you from seriously considering adding a virtual workforce to your mortgage operation. Some of the things I hear are:

- Bots are too expensive

- It takes a long time to develop and deploy bots

- Our technology team is so busy they couldn’t take on bots at this time

- We don’t have inhouse technology support, who is going to design and deploy bots for us

Let’s take a quick look at what is Robotic Process Automation

The easy way to explain RPA is a bot can mimic the keystrokes humans perform. The bot is programmed to perform the same manual tasks and routines that a human does at a much faster pace with a far lower error rate, near zero. Adding a little logic to the program will allow bots to react to the processes it completes or fails to complete.

In the past bots have been expensive to develop and deploy. Like everything technology related, over time the costs have come down while the capabilities have improved. One of the latest RPA advancements we have taken advantage of is a rapid RPA development platform designed specifically for the mortgage industry. Using this latest technology, RPA bots can be developed for a fraction of the cost and deployed in weeks rather than months.

It’s an understatement to say the mortgage industry is driven by technology. For IT departments the task lists are long and never ending. An issue many lenders have is getting RPA on their IT development list. Seeing this problem with so many of our clients, we knew we had to have a way to manage the entire RPA process so at the end of the day an RPA virtual workforce could be delivered with the least amount of impact on the IT department. Plus, the ongoing maintenance had to be managed to further reduce the impact to our client’s IT departments.

RPA is emerging as a key driving force in impacting the mortgage industry. A truly process-driven industry, RPA automates routine processes resulting in improved efficiencies and accuracy, reduced costs and improved turn times. As much as 85% of the process from initiating a new loan, processing, underwriting, document prep, funding, shipping and servicing can be automated. With the scale of efficiencies, whether loan volume is up or down, lenders taking advantage of this technology have many options to remove barriers, lower costs and grow their business.

We currently have 28 RPA processes for MeridianLink Mortgage, Encompass, and other LOS systems, that replace most of the standard manual workflows encounter during the loan process. For more information or to schedule a meeting with one of our RPA team members, visit our website at www.oncyberlink.com/mortgage-automation.

OpenClose and Cyberlink Software Solutions, we’re in the news!

We’re excited, the word about OpenClose and Cyberlink Software Solutions partnering is out. Together we’ve created a better, more robust MERS transaction management system for OpenClose clients. We’ve put together this list of links to our favorite articles. Hope you enjoy!

OpenClose & Cyberlink eRAMP Integration PR Coverage:

Publication: MortgageOrb

Publish Date: Wed. June 3rd

Article: https://mortgageorb.com/openclose-lenders-can-now-access-cyberlink-eramp-system

Publication: National Mortgage Professional Magazine

Publish Date: Wed. June 3rd

PROGRESS in Lending Association

Publish Date: Fri. June 5th

Publication: CUInsight

Publish Date: Wed. June 1st

Publication: Mortgage & Finance News

Publish Date: Wed. June 3rd

New Integration Enables OpenClose Lenders to Automate MERS® Loan Registration and Transfer via Cyberlink’s eRAMP System

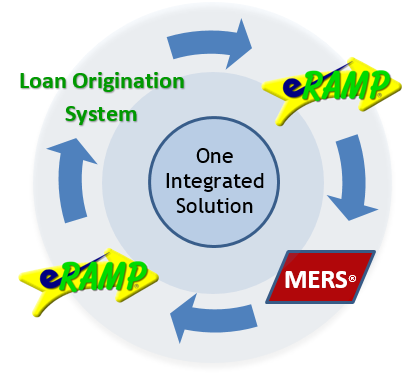

WEST PALM BEACH, Fla., June 3, 2020 — OpenClose®, the industry-leading mortgage fintech provider and omni-channel loan origination system (LOS), and Cyberlink Software Solutions, a provider of optimization and development solutions for mortgage lenders, announced the completion of an integration that eases the time consuming and laborious method of registering loans one by one with MERS®.

Cyberlink’s eRAMP MERS Transaction Management solution integration works by taking bulk loans that OpenClose lender customers need to register or transfer with MERS, and processing this important task efficiently, quickly, and accurately regardless of the number of loans to submit. eRAMP data then updates OpenClose’s LenderAssist™ LOS, which includes registration confirmation dates as well as transfer of rights confirmation dates.

“We continuously look for opportunities to automate redundant tasks. The integration with eRAMP accelerates workflow, reduces errors and frees OpenClose users to work on other tasks,” stated Vince Furey, CRO of OpenClose. “We are pleased to introduce eRAMP’s MERS end-to-end transaction processing solution to our customers knowing that it will save them valuable time and money.”

eRAMP has been relied upon for MERS® transaction processing by lenders large and small since 2003. Whether it’s registering thousands of loans or a couple dozen loans, it’s done with the click of a mouse and with minimal manual intervention by the lender. Confirmation reports along with details are provided back to the lender from eRAMP.

“We’re always excited when we deliver new features that save time and reduce costs for our customers,” said Greg Uttal, president of Cyberlink Software Solutions. “Our goal is to secure additional business and accomplish more with less by way of technology. With the new OpenClose integration, we’re right on target to deliver value to our mutual customers.”

About OpenClose:

Founded in 1999 and headquartered in West Palm Beach, Florida, OpenClose® is a leading enterprise-class, multi-channel loan origination system (LOS), POS digital mortgage and fintech provider that cost effectively delivers its digital platform on a software-as-a-service (SaaS) basis. The company provides a variety of innovative, 100 percent web-based solutions for lenders, banks, credit unions, and conduit aggregators. OpenClose’s core solution, LenderAssist™, is comprehensive loan origination software that is completely engineered by OpenClose using the same code base from the ground up. The company offers a RESTful API suite that standardizes system-to-system integrations, making them easier to develop, quicker to implement

and more cost effective. OpenClose provides lending organizations with full control of their data and creates a truly seamless workflow for complete automation and compliance adherence. For more information, visit https://www.openclose.com/ or call (561) 655-6418.

About Cyberlink Software Solutions:

Cyberlink Software Solutions, Inc. is a software development company that’s been creating innovative applications for mortgage professionals since 1995. We offer in-house developed software products and consulting services, including LOS implementation project management, LOS optimization consulting and MERS process improvement solutions. For more information, please call 800 518-0919 or visit https://www.oncyberlink.com.

Social Media: @OpenClose_LOS #MERSLoanRegistration #LoanOriginationSoftware #CyberLinkSoftwareSolutions #OpenClose

Media Contact:

Joe Bowerbank

Profundity Communications, Inc.

949-378-9685

jbowerbank@profunditymarketing.com

Enhanced data distribution option streamlines MERS transaction management for Encompass, OpenClose, LendingPad and many other LOS systems

WESTLAKE VILLAGE, CA April 24, 2020

A small enhancement is making a big difference for Encompass, OpenClose, LendingPad and other LOS users. The longest standing MERS transaction management system, eRAMP has made it much easier for LOS users to update dozens to thousands of loans in their systems with MERS transaction confirmation dates in minutes.

“Processing and updating one loan at a time is time consuming. Bulk processing is the way to successfully manage the fluctuations in loan production and gain maximum efficiency to reduce costs and errors when processing MERS loan transactions”, said Greg Uttal President of Cyberlink Software Solutions, Inc. developer of eRAMP for MERS. The bulk solution takes advantage of MERS data collected at time of loan registration and at transfer of rights so lenders can easily maintain MERS transaction status in their loan origination system in real time without manual data entry. Accurate records in the lender’s central point of data collection is important.

Using eRAMP’s new data distribution option expands the previous LendingQB full integration solution that has been available for many years. Now lenders have increased flexibility using eRAMP for MERS with more LOS systems than ever before.

About Cyberlink Software Solutions

Cyberlink Software Solutions, Inc. is a software development company that’s been creating innovative applications for mortgage professionals since 1995. We offer in-house developed software products and consulting services, including LOS implementation project management, LOS optimization consulting and MERS process improvement solutions. For more information, please contact Greg Uttal at 800 518-0919 or visit www.oncyberlink.com

IRS 4506-T Processing Suspended

The Coronoavirus effects mortgage loan processing with an immediate halt by the IRS to processing 4506-T requests. Effective immediately, 4506-T requests will not be processed by the IRS as it considers the impact of state and local shelter in place orders issued due to the COVID-19 outbreak.

A form 4506-T allows lenders to verify with the IRS the tax forms supplied by the applicant to prove their income match those in the possession of the IRS. The IRS can provide a transcript that includes data from these information returns.

As an alternative to obtaining tax transcripts from the IRS, applicants can download their tax transcripts and submit them directly to their lender. Visit the IRS website: https://www.irs.gov/