New eRAMP Enhancement in LendingQB Allows Lenders to Bulk Register Loans into MERS

New eRAMP Enhancement eliminates the need to register loans one by one into MERS, granting tremendous time savings.

COSTA MESA, Calif. (PRWEB) October 23, 2018

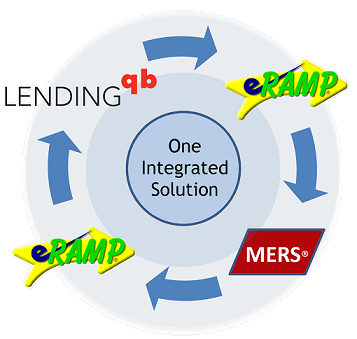

LendingQB, a provider of lean lending loan origination technology solutions, and Cyberlink Software Solutions, a provider of optimization and development solutions for mortgage lenders, have enhanced the eRAMP bulk loan integration with MERS to drastically reduce the time spent registering and transferring rights of loans.

This enhancement allows for bulk MERS transaction processing for all transaction types and instant loan registration and confirmation in one session. By eliminating the need to register loans one by one to MERS, lenders gain tremendous time savings and eliminate errors. In addition to loan registration, confirmation dates for all registered loans along with all three types of transfers of rights will then automatically populate back into LendingQB’s MERS status dates. An optional confirmation report is available to upload into lendingQB’s eDocs.

“It doesn’t matter if these bulk transfers are as few as one loan or thousands of loans,” said David Colwell, vice president of strategy at LendingQB. “Not only does it save lenders time, this automation absolutely removes the possibility of human error in the process, ensuring that lenders can hit their deadlines with no issue.”

“With all the eRAMP versions released since 2003, we are always most excited when we bring new features with immense automation and time savings to our clients,” said Greg Uttal, president of Cyberlink Software Solutions. “Our technology goal is always more business and less work for our clients. With our integration to LendingQB, that’s mission accomplished.”

###

About LendingQB

LendingQB is a provider of Lean Lending solutions for residential mortgage banking organizations. The Lean Lending solution consists of a 100 percent web browser-based, end-to-end loan origination system, best of breed integrations with key industry partners and ‘adoptimization’ services that result in faster cycle times and lower costs per loan. For more information, please call 888.285.3912 or visit http://www.lendingqb.com

About Cyberlink Software Solutions

Cyberlink Software Solutions, Inc. is a software development company that’s been creating innovative applications for mortgage professionals since 1995. We offer in-house developed software products and consulting services, including LOS implementation project management, LOS optimization consulting and MERS process improvement solutions. For more information, please call 800 518-0919 or visit https://www.oncyberlink.com

Original Post available from PRWeb: https://www.prweb.com/releases/new_eramp_enhancement_in_lendingqb_allows_lenders_to_bulk_register_loans_into_mers/prweb15844301.htm

Lenders Don’t Get Left Behind!

Lenders Don’t Get Left Behind!

According to the 2018 American Bankers Association State of Digital Lending Study, the majority of banks’ lending processes-including online application, on boarding, processing, underwriting and funding have yet to be overhauled through technology.

Technology plays a critical role in the current competitive, fast paced environment to not only provide exceptional service but also to remain profitable. Lenders who fail to take steps to optimize their lending practices will get left behind!

Steps to Optimize Your Loan Origination Practices

♦ Integrate data

♦ Eliminate Paper

♦ Analyze Performance

Integrate data – Cloud based point of sales systems like PreApp1003 and loan origination systems like LendingQB and MeridianLink offer integration to various data sources. This data, when combined with business rules can eliminate manual steps and provide an improved view of your borrower’s creditworthiness, as well as increased speed and accuracy in decisioning. A great POS system improves loan officer effectiveness and creates a data collection point that starts with the applicant.

Eliminate Paper – and eliminate the cost of copying and sending documents. Digital documents are sent and received in minutes rather than days and are secure and accessible online by both the lender and the applicant.

Analyze Performance – Most LOS systems provide reports that can be created and customized to your specific business needs to reflect production, trends, historical data, bottlenecks and staff performance. The review of these reports will result in identifying unprofitable loan programs and/or processes.

These are a few ideas to optimize your lending operation. Contact Cyberlink Software Solutions, Inc to discuss these ideas and more!

How to Improve Your Lending Operations

The real estate market is booming in 2018. Prices are 10% higher than last year, and homes are selling a whole week faster in some of the countries largest housing markets. If you’re a lender, these are great reasons to get excited. Like chum in the water, however, this booming market attracts all the sharks. Competition is ferocious, and getting ahead still requires a special touch. What will keep your organization a step ahead in this booming market? If you’re like many lenders, it’s implementing a powerful software solution like LendingQB, MeridianLink Loans PQ, or BNTouch CRM.

For example, LendingQB system consists of a cloud-based loan origination platform connected to more than 300 best-of-breed integration partners. It combines advanced technology with dedicated services, resulting in enhanced process efficiency and greater ROI. The only problem is you and your employees might not know exactly how to take advantage of this powerful tool. Installing a brand new system can seem overly complicated and daunting, and you don’t exactly have the time to interrupt your operations to take on a large project. As a partner to LendingQB and other LOS companies, we know how to tackle these challenges.

Your Operations Partner

As our tag line suggests, we solve operational problems for our clients while they do what they do best. We do this by bringing our clients four valuable resources that have a proven track record with some of the most successful lenders in the industry. At Cyberlink, we call these resources K.E.V.E.: Knowledge, Efficiency, Validation, and Experience. Here are just a few of the reasons why K.E.V.E. could benefit your operations:

[check_list]

- Knowledge – By working alongside consultants, you gain access to highly valuable information right at your fingertips. You can utilize us as a resource for a long, ongoing basis or for just a short special project. Think of us a knowledge tool you can use at your convenience.

- Efficiency – Think of us as employees without benefits. We’re highly skilled professionals who can help with implementation or post integration, but you don’t need to deal with the hassles that comes with adding us to your payroll. Due to the nature of our business, we know how to learn assignments quickly.

- Validation – In any business environment, it’s normal for employees to stick to specific habits and points of view. We can be the unbiased eye looking at a specific project or your overall business operations. We provide objective confirmation and supporting documentation when necessary.

- Experience – We work in many different types of lending environments (Mortgage Bankers, Brokers, Lenders and Credit Unions) and may have encountered your particular project or challenge before. Through this experience, we’ve developed best practices to help you fulfill your most challenging objectives.

[/check_list]

In upcoming posts, we’ll go into detail about how each aspect of K.E.V.E. has helped transform our client’s operations. Our ongoing, personalized support and guidance has empowered lenders in ways that have exceeded everyone’s expectations.

Why Lenders Love K.E.V.E.

Most lenders love the concept of hiring specialists to do the work that their employees do not have the time or expertise to handle. In-house projects fail more than they succeed for a variety of reasons: time to completion, cost to complete, loss of revenue due to preoccupied staff, etc. If a project is worth doing and improves service and ROI, everything possible should be done to expedite completion. The resources provided by our consultants make achieving this goal realistic.

Ginnie Mae Restricts Three Lenders from Main Securities Program

Ginnie Mae, or the Government National Mortgage Association, carefully decides which lenders are eligible to pool VA loans into Ginnie Mae backed securities. In an effort to improve security and transparency for its investors, the wholly owned government corporation has decided to restrict which pools three specific lenders can put their VA single family -guaranteed loans. The following lenders will be restricted from Ginnie Mae II custom pools only:

- Freedom Mortgage Corporation – July 1, 2018 through January 1, 2019

- SunWest Mortgage Company, Inc. – July 1, 2018 through January 1, 2019

- NewDay USA – April 1, 2018 and concludes October 1, 2018

Because these lenders will only be restricted from Ginnie’s II custom pools, some experts are predicting that there will only be modest market impacts. The period of restrictions is also relatively short, meaning these institutions may be allowed to include their VA loans in II pools again shortly. They will just need to create an “acceptable plan for achieving and maintaining prepayment speeds consistent with Ginnie Mae’s program requirements.”

In a statement released to the press, representatives from Ginnie Mae cited APM 18-02 and Section 3-21 in the organization’s MBS Guide. These guidelines deal with standards for prepayment activity of loans or loan packages included in Ginnie’s pools. When banks don’t meet these standards, representatives from Ginnie discuss the issue with them in an attempt to guide their policies in the right direction. In the meantime, NewDay, SunWest, and Freedom Mortgage Corporation will simply adjust some of their pricing and deliver their loans to the secondary market using different mechanisms.

Ginnie Mae to Modernize

In other news, Ginnie announced recently that it will be making major upgrades to its mortgage-backed securities platform in the next few years. The goal of the project is to decrease costs and risks, increase efficiencies and security features, and improve the user experience and overall system stability. Users will be introduced to a new centralized help desk while issuers will be getting a new portal called MyGinnieMae.

MyGinnieMae is being designed to provide enhanced security and a single entry point for all approved applications. One of the more exciting aspects of the project is the ability to accept digital promissory notes and other digitized loan files. The aim of When completed, it will be a full-service solution for users who want to access all of Ginnie’s business applications. The organization said that it intends to work closely with industry partners to capatalize on the investments its making in technology.

Have any questions about this news or any other topics related to working with Ginnie Mae? We can help. Call or contact us today!

eRAMP MERS ICE Migration Update #3

Today we completed eRAMP communication testing with the new MERS ICE Data Center. Previously, as noted in our last update, eRAMP successfully completed SFTP testing. This morning we completed XML Online Registration testing. While we were very happy to confirm eRAMP would be able to submit loans to MERS ICE Data Center the key for Cyberlink was to be able to do so with minimum impact to our clients.

That said there are only two changes that need to be made to eRAMP on the Client Setup screen (Settings>Client). The SFTP Host IP address has to be changed to the new ICE Data Center IP Address for testing and ultimately changed to the IP Address for production when you go live. The second change will be to the Online Registration URL. MERS provides two URLs for Online Registration. One for training/testing and the other for production when you go live. For specific details about IP Addresses and URLs MERS provides a document called ICE Migration Info Sheet. The ICE migration document has been distributed to MERS members and is available from MERS website. eRAMP will not require an update to communicate with the new ICE Data Center. Please be aware testing was completed using Windows 8.1 and Windows 10 operation systems. These two Windows operating systems are the only versions of Windows with the proper TLS version at the core to communicate with ICE.

What’s next; with testing completed by Cyberlink all eRAMP users should test eRAMP as soon as possible by changing the IP Address and URL using the test information provided by MERS. MERS has sent notices to all members requesting completion of testing by June 29th. Depending on how you would like to test eRAMP you could simply change the SFTP IP address and Online Registration URL in eRAMP to the test credentials. Or setup eRAMP on a separate workstation, not connected to your live version of eRAMP. If this is the case please contact support at support@oncyberlink.com for instructions or assistance.

Please visit eRAMP Client Resource Center for ICE conversion updates. If you have questions please submit a ticket through our support center at https://www.oncyberlink.com/client-resource/

Thank you,

eRAMP Support Team

Getting Seller/Servicer Approval from Fannie Mae

Fannie Mae is a crucial component of the modern home lending market in the United States. This government-sponsored enterprise purchases millions of loans every year on the secondary market, providing opportunities for countless families who would otherwise not be able to buy a house. As a lender, being an approved Fannie Mae servicer will likely be a one of the keys to your success. Fortunately, gaining approval is a relatively well organized process with clear steps. When you get help from our professionals, it’s even easier.

Eligibility Requirements

Before Fannie Mae will even consider accepting a new applicant, you must have at least 2 years of experience originating, selling, or servicing residential mortgages. You must also demonstrate ability to handle the type of mortgages for which your requesting approval. In addition, you’ll need to:

[check_list]

- Have adequate facilities and staff for handling relevant loans

- Be authorized to conduct business in your jurisdiction

- Have management control and internal auditing processes in place

- Implement policies on fidelity bonds as well as errors and admissions

- Have a minimum net worth of $2.5 million and history of profitability

[/check_list]

In addition to these requirements, Fannie Mae can impose additional stipulations at any time. Their philosophy is to examine the total circumstances of the applicant to see if they are a good match. At Cyberlink, we’ve helped a lot of clients meet these requirements, and we have a second nature ability when it comes to figuring out what Fannie Mae officials want.

Getting Started

Once you’ve determined that you meet all eligibility requirements, it’s time to fill out the servicer/seller application and go through the Quality Control (QC) Self-Assessment. It’s normal to have a lot of questions when going through both the application and the self assessment. Some of the language may seem confusing. For example, Fannie Mae expects lenders to calculate a target defect rate for their loans, but it may not be completely clear what that rate should be. A Fannie Mae approval consultant can help you calculate gross and net defect rates and compose plans to improve them.

Document Submission

After your initial application has been submitted and approved, you’ll be required to provide a very long list of documents that will prove you’re ready to work with Fannie Mae. Observing the full document checklist for the first time can seem daunting, but we can guide you through each item step by step and eliminate any confusion along the way. Here’s just a small sample of the items you’ll be required to submit:

[check_list]

- Financial statements from the previous three years

- Resumes from executive officers and senior management personnel

- Insurance proof, including deductibles, coverage amounts, and expiration dates

- Documents showing at least two warehouse lines of credit

- An abbreviated account of the company or organization’s history and mission

- A wide range of quality control documentation

[/check_list]

Gathering all the needed documentation can be one of the most overwhelming aspects of the approval process. With many institutions, there are no formatting standards or common procedures, but we’re here to help get everything organized and ready to go. For example, if your disaster recovery plan isn’t complete, we’ll help you make the necessary edits or additions to ensure everything meets Fannie’s standards.

Onboarding Process

Once you’re approved, the hard part is over. Fannie Mae is interested in having a diverse partnership of sellers/servicers, and they’ll provide a lot of personalized support in the final stages of the process. Despite Fannie’s involvements, it can be helpful to seek advice and counsel from outside consultants if a particularly difficult situation arises. We’ve got the experience, knowledge, and dedication required to solve a wide range of issues.